LWS Financial Research NO ES un servicio de asesoria financiera, ni su autor está cualificado para ofrecer este tipo de servicios.

Todo el contenido de esta web y publicaciones, así como todas las comunicaciones por parte del autor, tienen un propósito formativo y de entretenimiento, y bajo ninguna circunstancia, expresa o implícita, deben ser consideradas asesoramiento financiero, legal, o de otro tipo. Cada individuo debe llevar a cabo su propio análisis y tomar sus propias decisiones de inversión.

Note: this article was updated on March 24, 2025. The original release was on July 30, 2024, when the stock was trading at 56p/share.

Introducción y modelo de negocio

Sylvania Platinum is a producer of platinum group metals (PGMs), with a focus on platinum, palladium, and rhodium. Specifically, Sylvania produces these elements by processing tailings from mining operations in South Africa, where they also own several deposits and PGM projects under development. For those familiar with this publication, their business model is similar to that of Amerigo Resources.

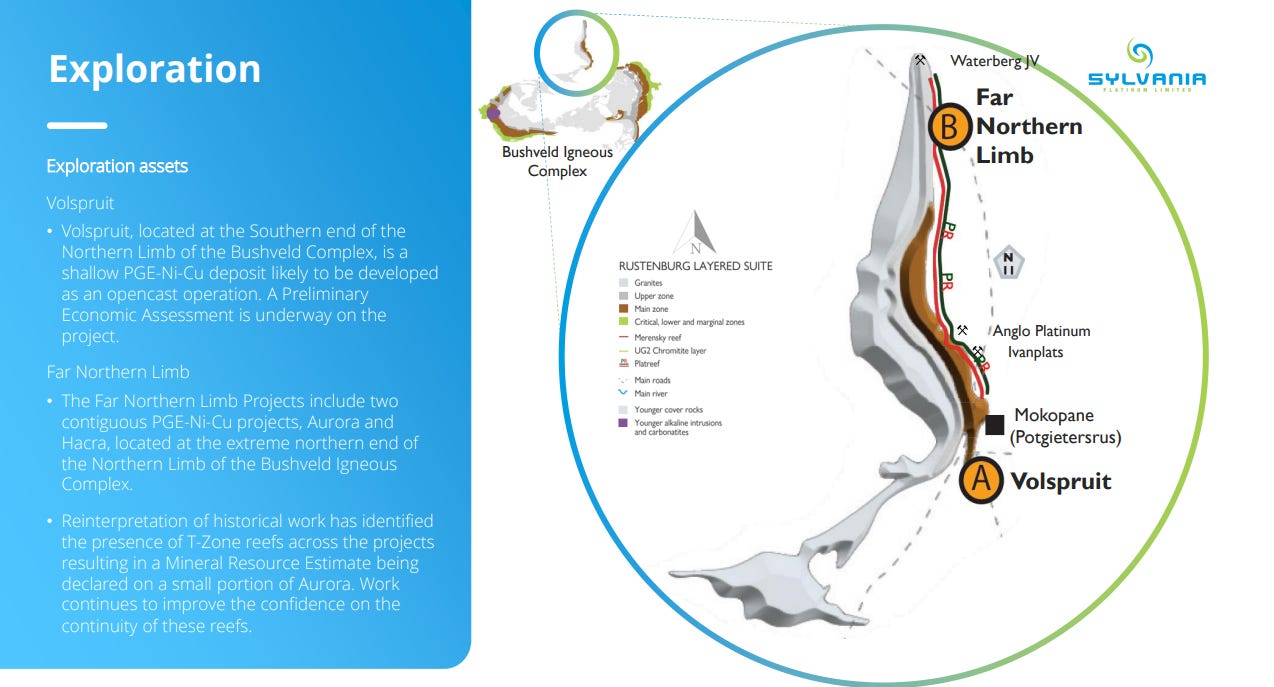

Their operations are located in the northern part of South Africa, near Johannesburg, and are divided between assets in production (or near production) and assets in the exploration or development phase.

Production

Within this category, there are two main assets (groups):

Sylvania Dump Operations (SDO): This includes a set of six processing plants that treat chrome tailings (both historical and fresh) to extract PGMs from the host mines. This is a mutually beneficial relationship: Sylvania does not incur the typical risks of mining operations and ensures a steady flow of material, while the mine operators benefit economically from waste material. The annual production is approximately 74,000 ounces of 4E PGM (a basket that includes palladium, platinum, rhodium, and gold).

Thaba Joint Venture (Thaba JV): In 2023, they entered into an agreement to develop a 50%-50% joint venture with Limberg Chrome Mine to process the tailings that this miner will produce. The initial mine life is estimated at 10 years, and production will be approximately 6,800 ounces/year of PGMs and 210,000 ounces of chrome attributable to Sylvania starting in 2026, significantly increasing their production volume and diversifying the minerals they are exposed to. According to the consensus on metal prices (which I believe are too conservative), the payback period for this investment will be 3 years.

In addition to their production (or development) assets, Sylvania has a portfolio of exploration-stage assets, which we will value at 0 for this analysis. They are investing very little capital in these assets, given that we are in the lowest phase of the PGM capital cycle, and their capital allocation priorities and financial prudence advise against it.

Platinum Group Metals (PGMs)

PGMs are relatively unknown and generate very little investor interest. However, their uses are diverse and highly relevant, as it is very difficult to replace their properties with other materials. The physical scarcity of these elements, which are considered precious metals (also used in jewelry and investment), assigns them a very high nominal value, but they are used in small quantities, making them a tiny part of the costs of the products in which they are integrated, causing demand to be relatively inelastic to price.

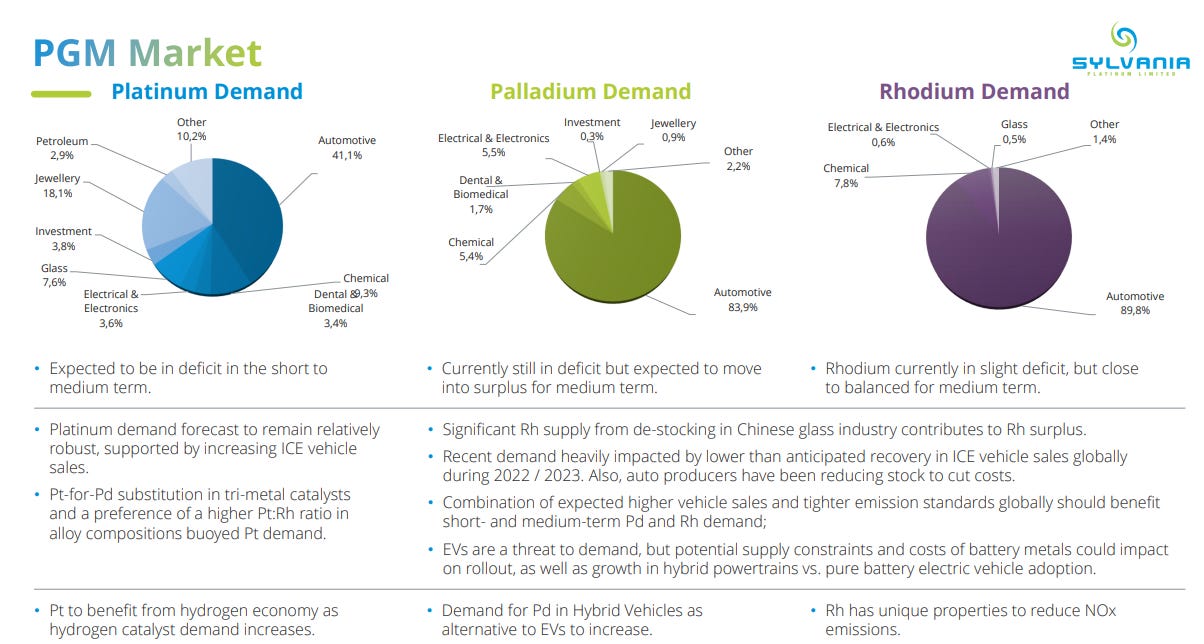

The most interesting property of these metals is their role as catalysts (i.e., they accelerate certain chemical reactions without being consumed or altered in the process), whose main application is reducing emissions in internal combustion engine vehicles (and also hybrids), though recently they have seen significant demand in hydrogen-powered vehicles. The following chart shows the main sources of demand for Sylvania’s three primary products.

As well as the outlook for these metals in terms of supply and demand. The company itself, reflecting market consensus, expects persistent (and growing) deficits in platinum, palladium, and rhodium over the next five years.

The consensus narrative now is that internal combustion engine cars will be quickly phased out, almost disappearing by 2030, which would significantly disrupt PGM demand, leading to minimal investor interest. However, we see that several car manufacturers, like Renault, Ford, Mercedes, and Porsche, are increasingly retracting from their electrification ambitions, understanding that demand for this new technology does not yet exist on the necessary scale for the transition. The only segment still growing in new categories is hybrid cars, which do consume PGMs. For more insights into these concepts, here is a link to an article by Alberto Álvarez and a video we recorded with him discussing the macro thesis supporting this investment idea.

With more resilient demand than the market expects, it is crucial to analyze supply. Palladium supply peaked in 2019 with over 7 million ounces extracted and 2.6 million ounces recycled. Since then, miners have reduced production or put mines into maintenance (primary supply has fallen 10% since 2019), and significant mining expansions by major PGM producers have been delayed or canceled due to stagnant and low underlying prices. Palladium production is dominated by a single Russian company, Nornickel, with a 43% market share, making this supply source inelastic to price. Currently, in a market context where most producers are unprofitable and there is a significant deficit (expected to last for years), PGM mines will continue to deplete, close, or go into maintenance, further exacerbating the deficits.

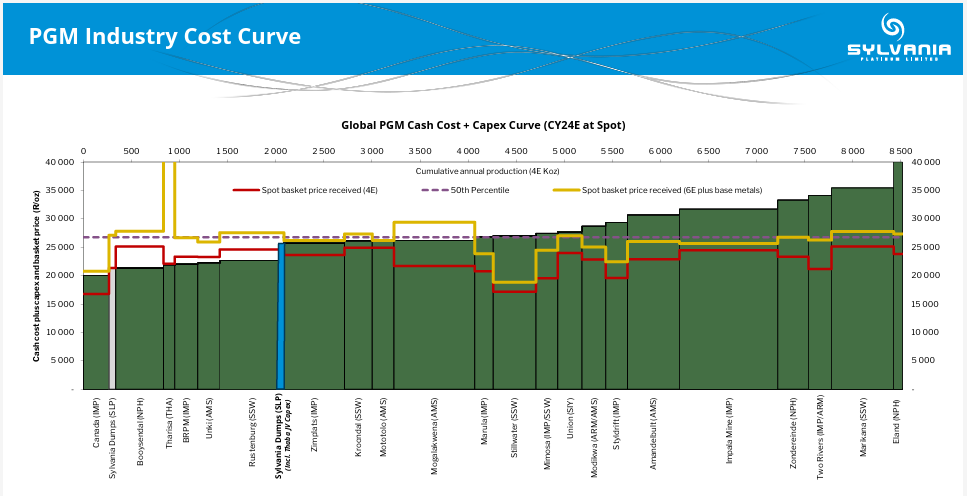

In the following chart, we can see the industry’s cost curve and how, at current prices, there are very few profitable producers. Sylvania appears in the first quartile, but it is actually the lowest-cost producer, since this cost curve also includes CAPEX, and we’ve seen that the company is engaged in a very significant expansion program.

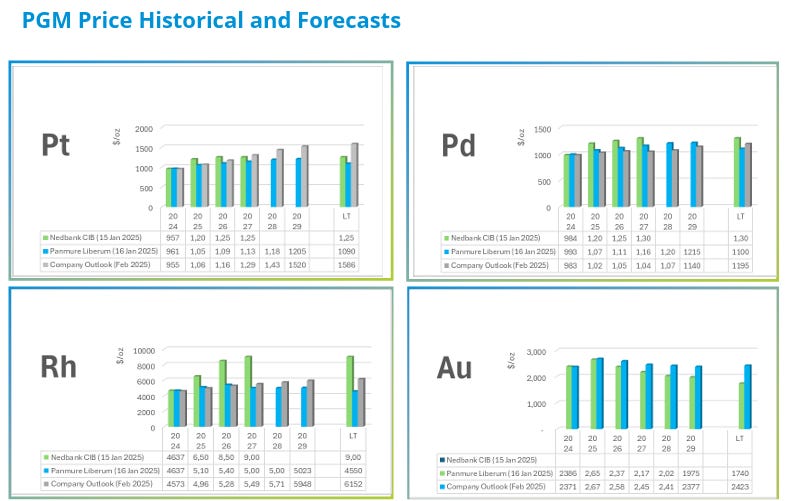

The most important thing to understand is that the current situation—barring a total and immediate technological disruption that drastically reduces demand for PGMs—is unsustainable: at current prices, and even considering that a large part of the supply (coming from Nornickel) is produced at negative margins, almost all producers are losing money (and even less so able to incentivize new projects), while at the same time we are seeing market deficits. Eventually, as happened with uranium, this will change, and the price of the underlying commodities will rise to meet the profitability needs of marginal producers. As is often the case, current sentiment is extremely pessimistic and based on the assumption that internal combustion engine vehicles will disappear immediately. In the following table, we can see the current consensus for the four main metals Sylvania produces, which, with the exception of platinum, show (according to analysts) very bleak prospects. This price consensus is what the company uses for its projections and guidance, and in my view, they will be positively surprised, adding a new layer of optionality to the investment.

A partir de aquí el contenido es solo para suscriptores de pago.

Si ya estás suscrito Iniciar Sesión