Model Portfolio

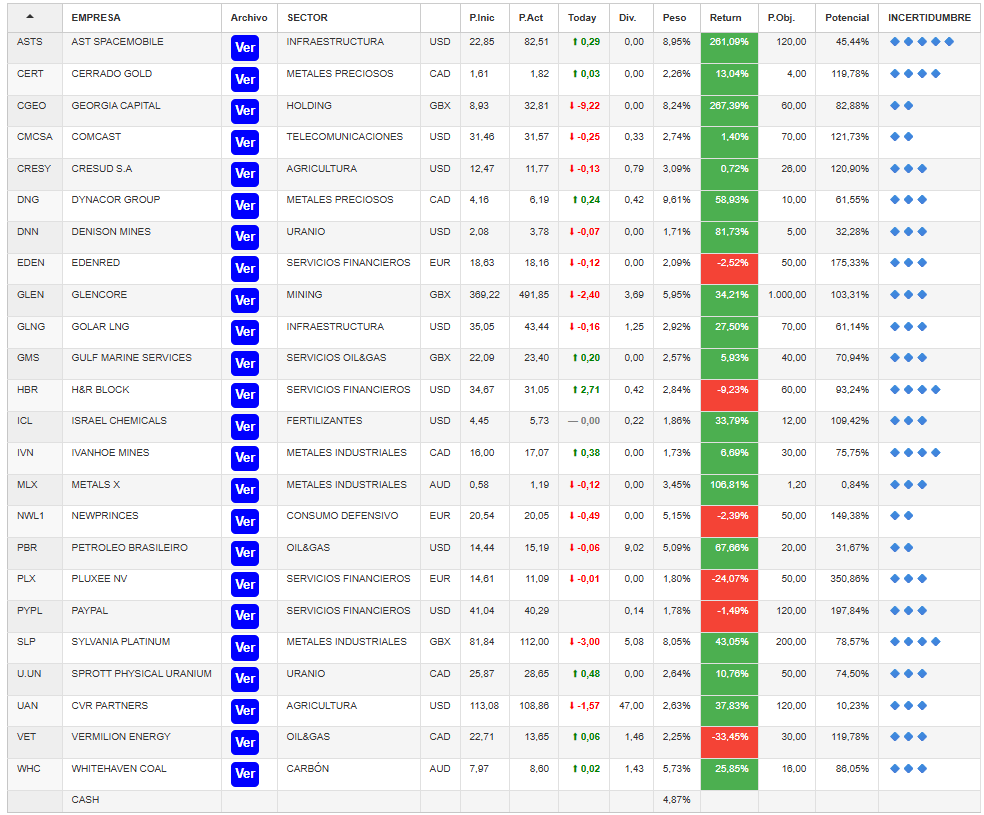

Year to date, the model portfolio is up +13.45%, versus -0.89% for the S&P 500 (S&P in euros), and +192.4% since inception (September 2022), compared with +48.9% for the S&P 500. The model portfolio, as of Friday’s close, is as follows:

-fr_premium_desde

This week, the cash from the model portfolio continued to be deployed into various ideas, both existing and new:

Sold Valaris, due to the merger notice with RIG, at 76$/s.

Increase in position in HRB 0.00%↑ at $32.68 per share.

New position initiated in PYPL 0.00%↑ at $41.04 per share.

New position initiated in CMCSA 0.00%↑ at $31.46 per share.

Next, we will review the main developments from the model portfolio companies during the week:

AST Spacemobile

AST SpaceMobile has just completed the deployment of its BlueBird 6 satellite, which incorporates the largest commercial antenna ever deployed in low Earth orbit, with an approximate surface area of 2,400 square feet. An aperture of this size enables direct connectivity with conventional smartphones, without additional hardware, offering 4G and 5G services — voice, data, and video — from space. The company cites peak speeds of up to 120 Mbps and, more importantly, a tenfold increase in bandwidth capacity compared to BlueBirds 1–5. At the same time, the company reaffirmed its deployment plan: between 45 and 60 additional satellites by the end of 2026, with launches scheduled every one to two months. If the architecture is operationally validated and the launch schedule is met, AST could consolidate a unique position in the direct-to-device connectivity segment.

Simultaneously — and somewhat surprisingly, given that management had reiterated that all necessary funding was secured — AST SpaceMobile has announced a $1 billion private offering of senior convertible notes due 2036.

The key will lie in the terms: coupon, conversion premium, and any potential call or hedging provisions. If the premium is high, the market will interpret it as confidence in the company’s upside potential; if it is tight, it will signal that management has prioritized certainty over cost of capital. From a shareholder’s perspective, the takeaway is mixed. On one hand, greater liquidity reduces execution risk and the likelihood of near-term dilutive equity raises. On the other, potential conversion introduces deferred dilution if the project succeeds.

Valaris

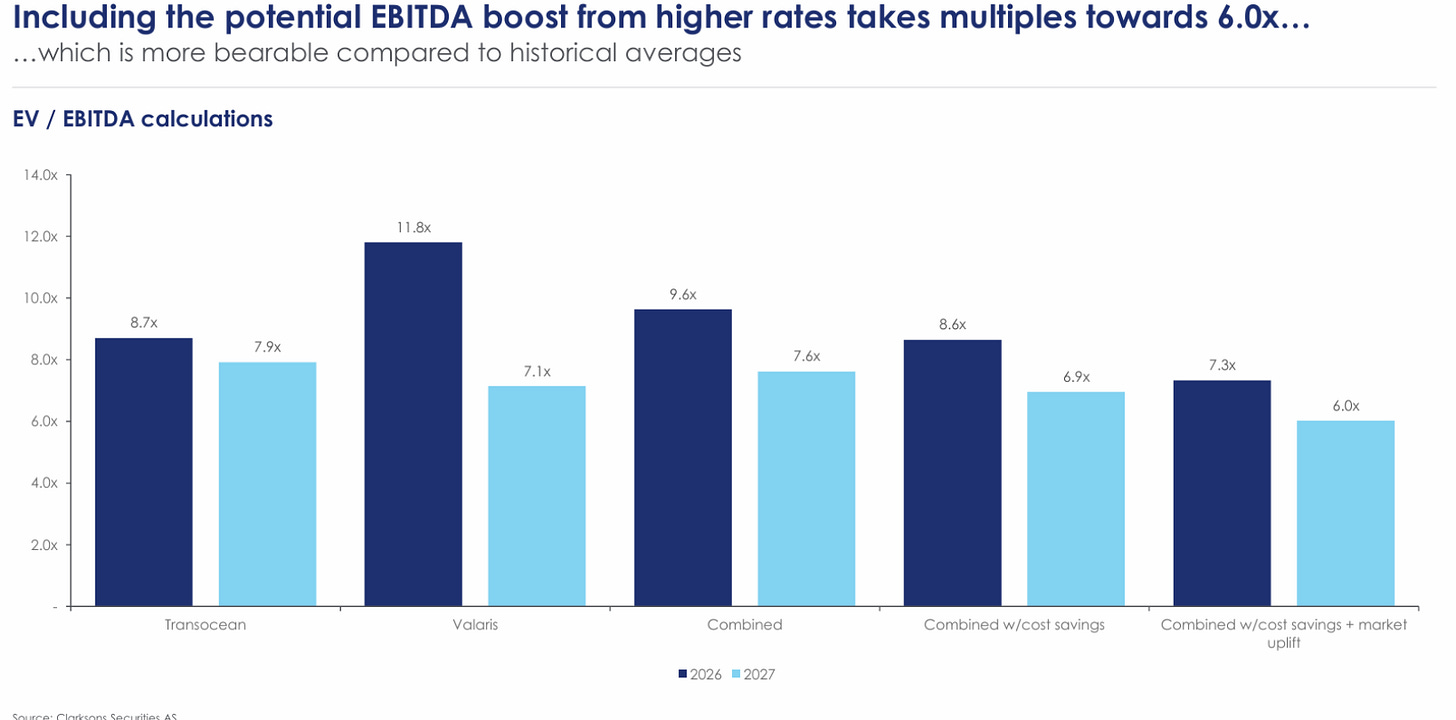

Consolidation in offshore drilling is now a reality. Transocean and Valaris have announced a merger through an all-stock exchange that values the transaction at $5.8 billion (at the time of announcement, now higher), creating a company with a pro forma enterprise value close to $17 billion and an estimated market capitalization of $12.3 billion. Current Transocean shareholders will own 53% of the new group, while Valaris shareholders will hold 47%.

Beyond the arithmetic, this marks the creation of an undisputed leader in offshore drilling, with a combined fleet of 73 rigs — 33 ultra-deepwater drillships, 9 semisubmersibles, and 31 modern jackups — and an aggregate backlog of approximately $10 billion. In a cyclical industry, contractual visibility is power. And here, visibility is high.

From a strategic standpoint, the transaction has clear industrial logic. Transocean brings a dominant position in ultra-deepwater; Valaris complements it with meaningful exposure to jackups, particularly in the Middle East, where structural activity from NOCs supports utilization. The result is a rebuilt player capable of operating at any depth and in any relevant basin, from the deepwater “golden triangle” to the shallow waters of the Gulf and the Middle East. The company estimates cost synergies in excess of $200 million, in addition to Transocean’s ongoing cost reduction plan (more than $250 million accumulated through 2026). In theory, greater scale should translate into higher operational efficiency, stronger bargaining power with suppliers and customers, and, above all, sufficient pro forma cash generation to accelerate deleveraging toward a target ratio of 1.5x within 24 months.

There are, however, several relevant nuances. First, this is an all-stock transaction, meaning there is no cash premium and no additional leverage required to execute it. Second, management and the board will be clearly dominated by Transocean, reducing governance uncertainty but also signaling who is effectively absorbing whom. Third, the timing within the cycle is no coincidence: the merger comes amid sustained recovery in floater dayrates and high utilization in jackups, with the market beginning to price in a structurally tighter supply environment. If the deepwater investment cycle continues, the operating leverage of this new entity could be significant — but a balance sheet less robust than that of its peers, who will also benefit from the improving cycle, may delay capital returns.

Cresud S.A

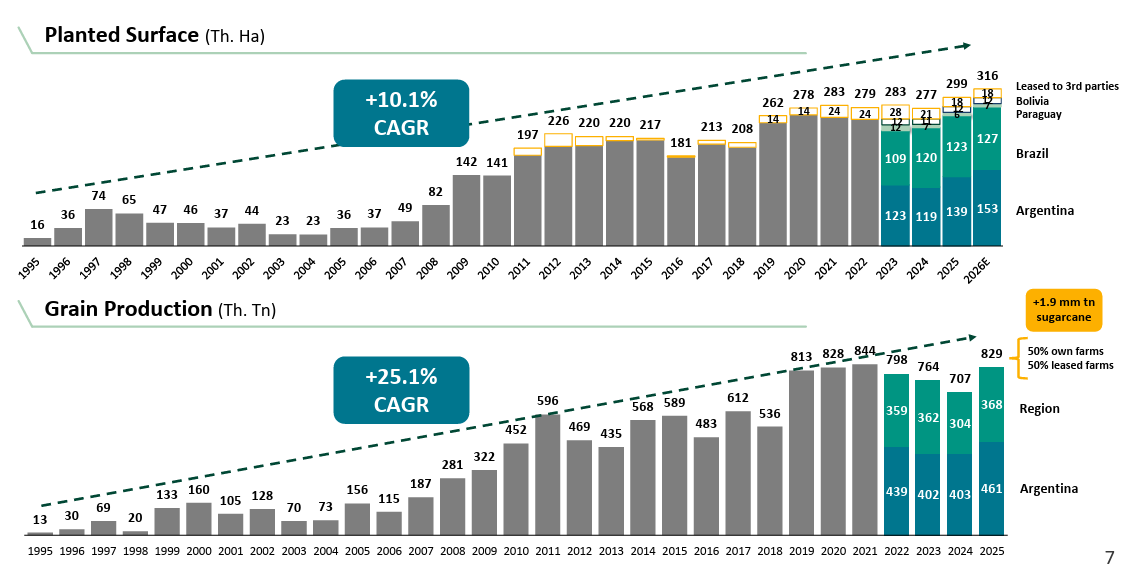

The operating backdrop for Cresud is beginning to turn in its favor after a long period of transition and headwinds. Soybean and corn prices, both in nominal and inflation-adjusted real terms, remain at historically low levels. In other words, the starting point is depressed, but volumes continue to grow — both in planted acreage and grain production — positioning the company well for the next turn of the cycle.

This is compounded by a modest yet relevant reduction in export taxes by the government, in line with prior promises: soybeans move from 26% to 24%, corn and sorghum from 9.5% to 8.5%, and wheat and barley from 9.5% to 7.5%. It is not a fiscal revolution, but it is a change in direction. Even more important is exchange rate convergence. The gap between the official and parallel dollar — a chronic distortion that drained incentives — has narrowed significantly. Producers are beginning to receive an exchange rate closer to the real one, while the tax burden declines. The combined effect is greater liquidity in the agricultural and livestock sectors, along with a tangible improvement in operating margins.

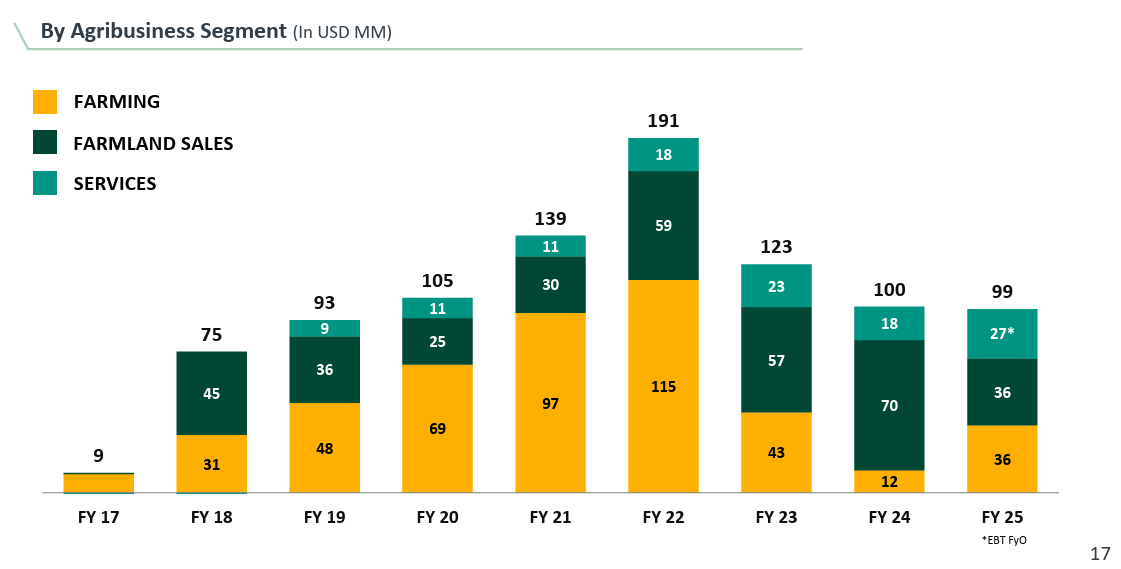

In the first half, the company reported a profit of ARS 248.8 million compared to losses in the prior year. A large portion of the improvement stems from the revaluation of investment properties, particularly through IRSA, rather than purely operational performance. Even so, the underlying real estate business is also recovering. Shopping malls, offices, and hotels are showing growth in revenues and EBITDA — especially hotels, with nearly 45% growth — reflecting normalization in occupancy rates and pricing. Despite lower land sales, both agricultural EBITDA and services EBITDA continue to improve, reducing cyclicality and strengthening the core business.

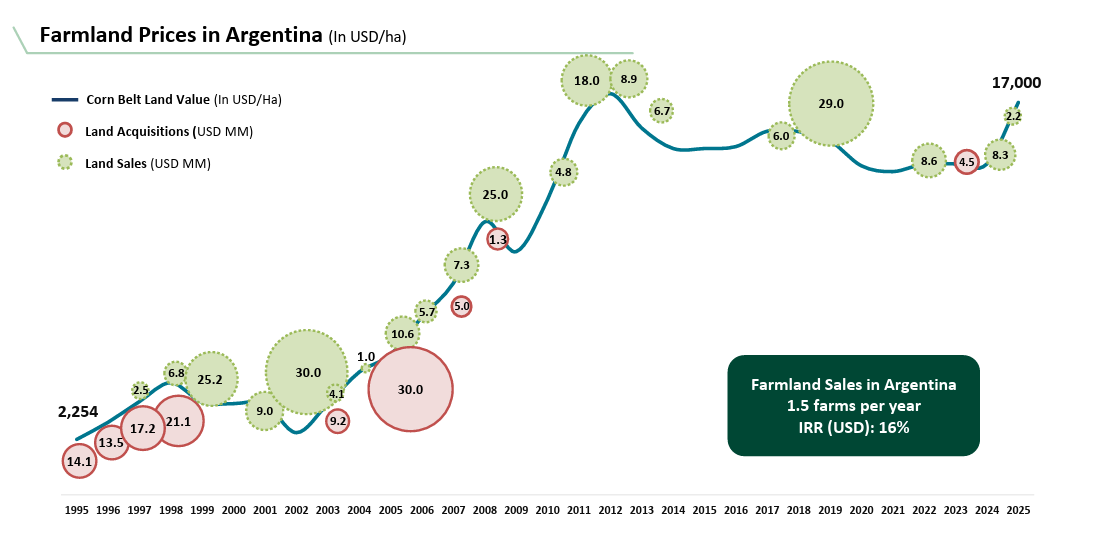

Cresud currently combines three compelling vectors: real assets in a context of macro normalization — which significantly enhances land values — operational improvement in livestock through greater production intensity, and a balance sheet that is beginning to reflect Argentina’s new exchange rate regime. In fact, although still depressed, agricultural land prices in Argentina are rising strongly and are beginning to approach parity with neighboring regions.

On shareholder returns and capital allocation, the company distributed ARS 93 billion in dividends — approximately $65 million — with 70% paid in cash and 30% in kind via IRSA shares, in addition to distributing close to 1% of additional share capital. In a country historically hostile to minority shareholders, this is not a minor detail — and it suggests that something may indeed be changing.

-fr_premium_hasta

⚠️ Conflict of Interest Disclosure (EU Regulation 596/2014 – MAR)

This publication is intended exclusively for informational and educational purposes. It does not constitute personalized investment advice or an invitation to buy or sell financial instruments.

The authors and/or contributors may hold positions—directly or through a model portfolio—in some of the securities mentioned. These positions may change without prior notice. This circumstance may represent a potential conflict of interest in accordance with Regulation (EU) 596/2014 (MAR).

The opinions expressed reflect the authors’ views at the time of publication. Each reader should independently assess the information and, if necessary, seek professional financial advice.

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to provide such services.

All content on this website and publications, as well as all communications from the author, are intended for educational and entertainment purposes only and should under no circumstances, whether explicit or implicit, be considered financial, legal, or other types of advice. Each individual should conduct their own analysis and make their own investment decisions.