Model Portfolio

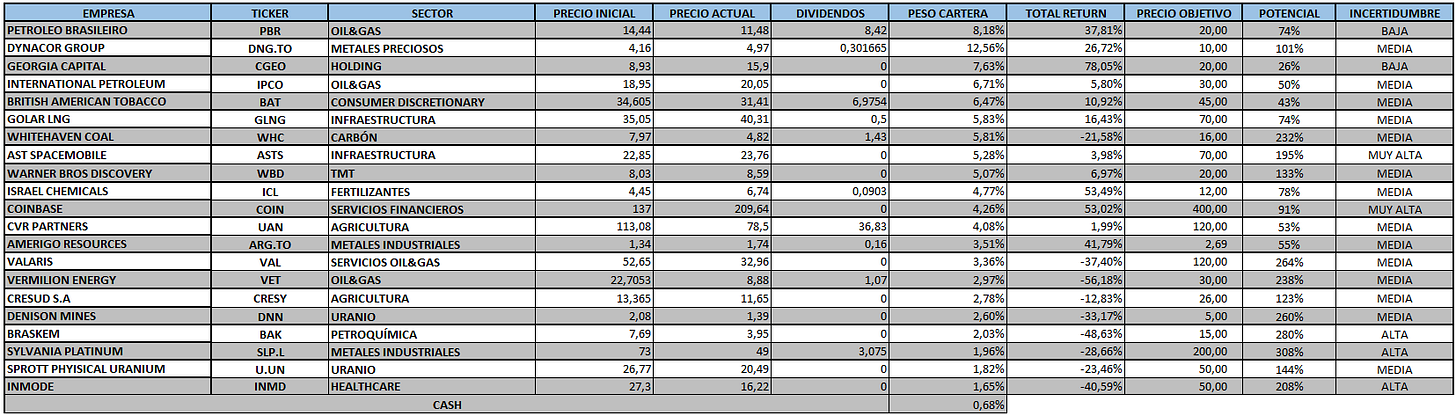

The model portfolio’s return is -8.17% YTD compared to -5.76.% for the S&P500 (our portfolio mesured in € terms, which is weighting -10% in our portfolio this year vs the S&P in $), and +53.9% versus +36.3% for the S&P500 since inception (September 2022). The model portfolio, as of Friday’s close, is as follows:

Below, we’ll review the main developments of the companies in the model portfolio this week:

AST SpaceMobile

Rakuten Mobile and AST SpaceMobile achieved a significant technical milestone: they successfully completed a broadband video call between regular smartphones using low Earth orbit satellites, without the need to modify the devices. The experiment was conducted via Rakuten’s ground station in Fukushima, which sent a signal to a BlueBird Block 1 satellite, which then retransmitted it to a mobile phone in Tokyo. All of this was done using a standard video calling app, demonstrating the technical viability of a satellite network integrated with existing devices.

The goal is ambitious: to launch the commercial Rakuten Saikyo service in Japan starting in the fourth quarter of 2026. By then, AST expects to have at least 45 operational satellites in orbit, part of the 60 launches planned between 2025 and 2026. Currently, they already have 5 satellites covering Japan, the U.S., and Europe.

Dynacor Group

Despite a weak February, Dynacor closed an excellent first quarter with sales of $80 million, setting a new quarterly record for the company. In March alone, sales reached $28.8 million (keep in mind that a shipment from February was moved to this month), marking the second-highest monthly figure in its history, driven almost entirely by the gold price, which averaged $3,020/oz (vs. $2,187 in March 2024), a +38% year-over-year increase.

The volume processed at the Veta Dorada plant remained stable at 15,000 tonnes, confirming that the improvement is mainly due to price rather than capacity expansion. The upward trend in gold prices has enabled Dynacor to record 15 consecutive months of year-over-year sales growth.

With an average price of $2,878/oz so far in 2025, Dynacor is on track to meet its annual sales guidance of between $345 and $375 million. Strong momentum for one of the key gold positions in the portfolio.

Another good week of value creation by portfolio companies.

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to provide such services.

All content on this website and publications, as well as all communications from the author, are intended for educational and entertainment purposes only and should under no circumstances, whether explicit or implicit, be considered financial, legal, or other types of advice. Each individual should conduct their own analysis and make their own investment decisions.